Motivation

Banca Intesa Belgrade recognized the inefficiencies of managing multiple administration systems for their digital banking channels. As the number of channels grew, so did the complexity of their administration, leading to delays, inconsistencies, and operational challenges.

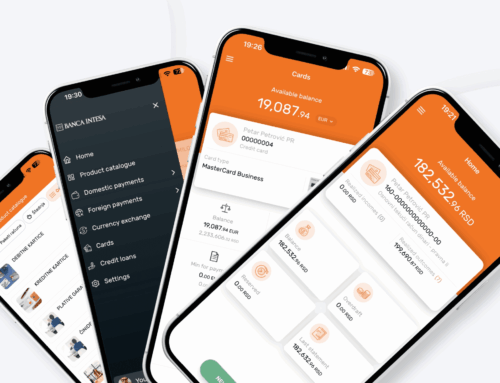

To address these issues, the bank sought a unified solution to streamline the management of digital channels, improve reliability, and enable faster service delivery. This vision led to the implementation of Digital BizAdmin, a robust and user-friendly platform designed to centralize and simplify the administration of all digital banking services.

Procurement Process

Intesa Belgrade approached GET as a trusted vendor for customized solutions with a clear mandate: deliver a solution that integrates with all existing channels while allowing for seamless addition of future channels. Critical requirements included:

- Support for core functions like service activation, modification, and deactivation.

- Integration with the bank’s core systems and diverse digital channels, including Asseco Office Banking, Halcom Corporate Banking, GET BizMobi, and Payten IPS.

- Customizable workflows, such as four-eyes approval, to enhance operational security.

- Capabilities for billing, data export, and document generation.

GET’s Digital BizAdmin emerged as the result of this cooperation, offering the flexibility, integration capabilities, and ease of use the bank needed.

Project Execution

The implementation was completed within the planned timeline, leveraging GET’s expertise and a collaborative approach with Intesa Belgrade’s team.

Key Features Delivered:

- Unified Channel Management:

- One platform to administer all digital channels, replacing disparate systems.

- Support for service activation, deactivation, editing, and monitoring.

- Seamless Integration:

- Compatibility with the bank’s core systems and third-party channels like e-banking and mobile banking platforms.

- Administration of card reader distribution, SMS, and email notifications.

- Customizable Workflows:

- Support for secure approval mechanisms like four-eyes approval.

- Ad hoc and monthly fee billing.

- User Collaboration & Role Management:

- Enhanced user cooperation with role-based permissions for sensitive operations.

- Scalability:

- Designed for future growth, enabling the effortless addition of new channels.

Results

The implementation of Digital BizAdmin has transformed the administration of Banca Intesa Belgrade’s digital banking channels:

- Operational Efficiency: A single platform for all channels has reduced administrative overhead and improved service delivery times.

- Enhanced User Experience: Faster, more reliable system performance has boosted employee productivity.

- Scalability: The bank can now easily integrate new digital channels, ensuring agility in adapting to market demands.

- Improved Client Service: Streamlined operations enable faster response times, enhancing customer satisfaction.

The Future

Digital BizAdmin continues to evolve with the needs of Banca Intesa Belgrade. GET provides ongoing support and updates, ensuring the platform remains cutting-edge. Future enhancements include additional analytics capabilities, more advanced reporting, and expanded integration with upcoming digital banking channels.

Conclusion

Digital BizAdmin has redefined digital channel administration for Banca Intesa Belgrade, demonstrating the power of innovation and collaboration in addressing complex banking challenges. This success story highlights the platform’s role in driving operational excellence and preparing the bank for future growth.

Want to find out more? Schedule a Discovery Call with our experts!